The Best Strategy To Use For Insurance Agency In Jefferson Ga

Wiki Article

An Unbiased View of Business Insurance Agent In Jefferson Ga

Table of ContentsThe Only Guide to Business Insurance Agent In Jefferson GaThe Main Principles Of Home Insurance Agent In Jefferson Ga Fascination About Insurance Agent In Jefferson GaLittle Known Questions About Insurance Agent In Jefferson Ga.

, the typical yearly cost for an auto insurance plan in the United States in 2016 was $935. Insurance policy also assists you prevent the decrease of your car.The insurance coverage safeguards you and assists you with cases that others make against you in mishaps. The NCB could be offered as a discount rate on the premium, making auto insurance coverage much more budget friendly (Business Insurance Agent in Jefferson GA).

A number of aspects influence the costs: Age of the vehicle: Oftentimes, an older vehicle prices much less to insure compared to a newer one. New vehicles have a higher market value, so they cost more to repair or replace.

Specific cars consistently make the regularly taken listings, so you could have to pay a higher premium if you own one of these. When it comes to auto insurance coverage, the three primary types of policies are obligation, crash, and thorough.

Not known Details About Insurance Agent In Jefferson Ga

Motorcycle protection: This is a policy specifically for motorcycles since vehicle insurance doesn't cover motorbike mishaps. The advantages of auto insurance much outweigh the risks as you can end up paying thousands of bucks out-of-pocket for a crash you trigger.It's usually far better to have more insurance coverage than not nearly enough.

The Social Safety and Supplemental Security Revenue disability programs are the biggest of a number of Federal programs that offer help to people with impairments (Home Insurance Agent in Jefferson GA). While these two programs are different in several methods, both are administered by the Social Protection Management and only individuals that have a special needs and meet clinical requirements might get approved for benefits under either program

Make use of the Perks Qualification Testing Tool to figure out which programs might be able to pay you benefits. If your application has recently been refuted, the Internet Appeal is a starting factor to request a testimonial of our decision regarding your eligibility for disability advantages. If your application is refuted for: Medical reasons, you can finish and send the Allure Demand and Charm Disability Record online. A subsequent analysis of employees' payment insurance claims and the level to which absence, spirits and hiring great employees were problems at these companies reveals the positive effects of providing health and wellness insurance policy. When contrasted to organizations that did not use medical insurance, it shows check my reference up that offering emphasis caused improvements in the ability to hire great employees, decreases in the variety of employees' payment insurance claims and reductions in the extent to which absence and productivity were problems for emphasis companies.

Business Insurance Agent In Jefferson Ga for Dummies

6 reports have actually been launched, including "Care Without Coverage: Too Little, Too Late," which locates that working-age Americans without wellness insurance are most likely to receive as well little healthcare and obtain it also late, be sicker and pass away quicker and get poorer care when they are in the health center, also for acute scenarios like a car crash.The research writers also keep in mind that expanding protection would likely result in a boost in actual source cost (despite that pays), due to the fact that the uninsured receive concerning fifty percent as much healthcare as the independently insured. Wellness Matters released the research study online: "Just How Much Medical Care Do the Uninsured Usage, and That Spends for It? - Business Insurance Agent in Jefferson GA."

The obligation of giving insurance for workers can be a difficult and occasionally costly task and many little businesses believe they can't manage it. What advantages or insurance policy do you legitimately require to supply?

How Business Insurance Agent In Jefferson Ga can Save You Time, Stress, and Money.

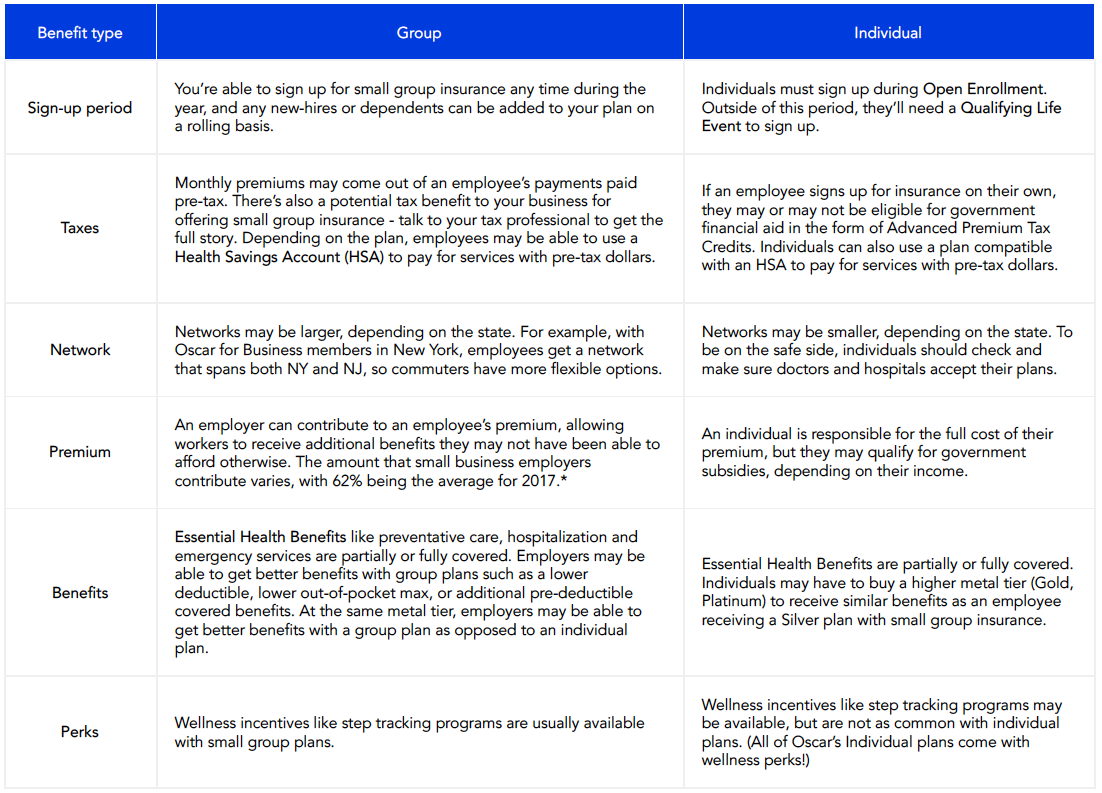

Employee benefits usually begin with wellness insurance policy and team term life insurance policy. As component of the health insurance package, an employer may opt to offer both vision and dental insurance policy.

With the rising pattern in the expense of medical insurance, it is practical to ask workers to pay a percentage of the coverage. Many services do put the majority of the price on the worker when they give access to health and wellness insurance coverage. A retirement (such as a 401k, basic plan, SEP) is typically used as a fringe benefit as well - https://www.behance.net/jonportillo1.

Report this wiki page